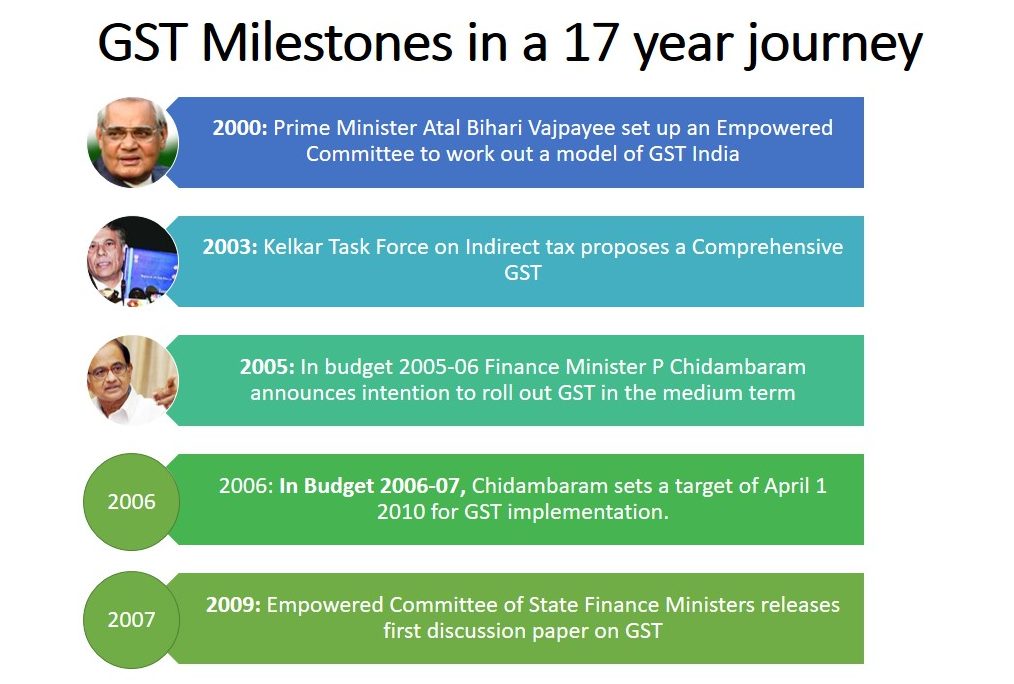

Milestone of GST in India

by thinkman · Published · Updated

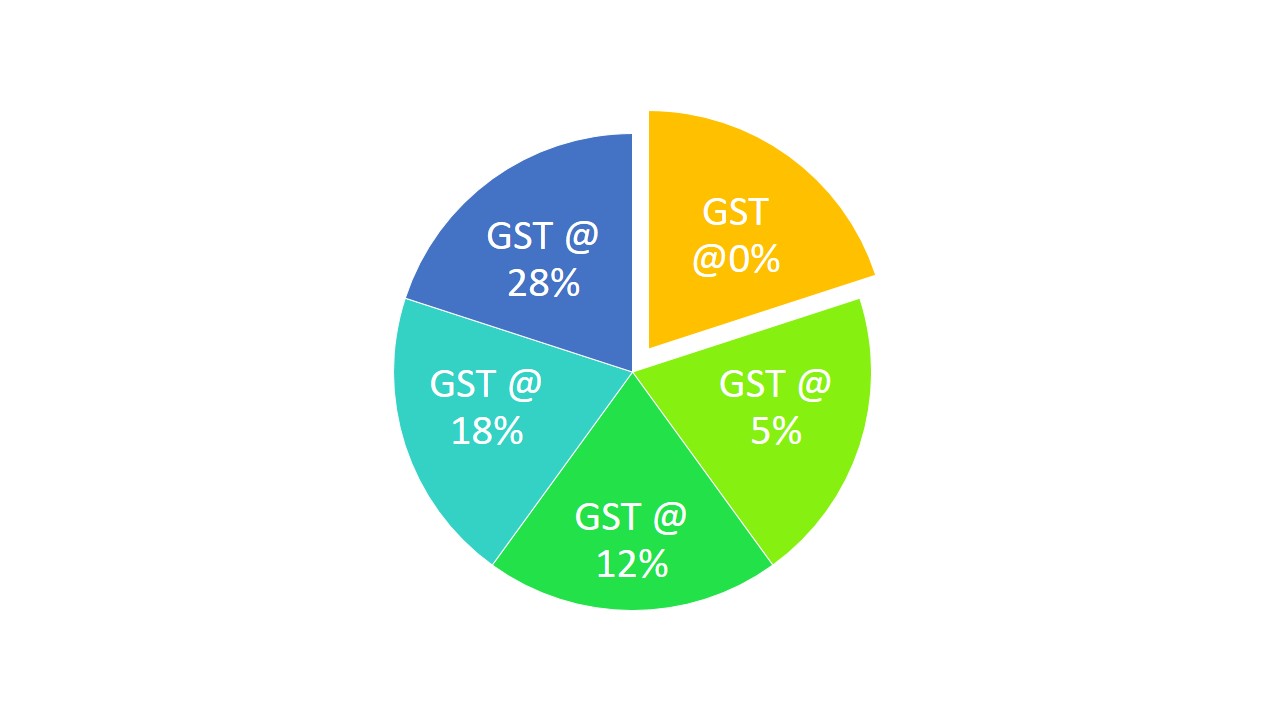

GST Tax Slabs

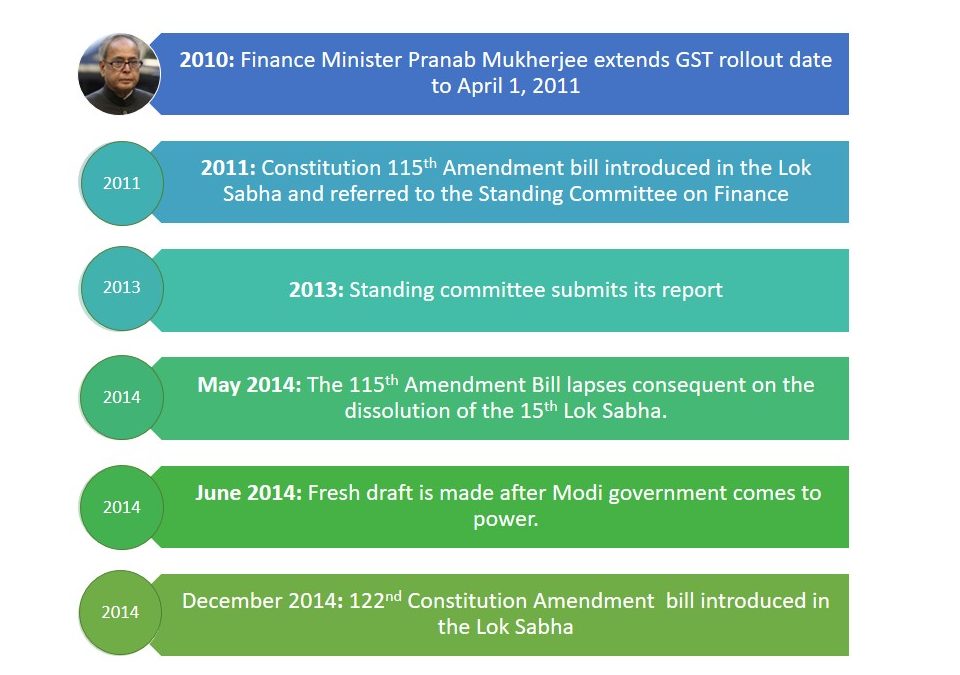

In 2011, Constitution 115th amendment bill was introduced in Lok Sabha and was referred to Standing Committee on Finance but it finally lapsed on May 2014 without being passed. Then with the regime change at center in May 2014, change of leadership came and work again started with the vigor of Narendra Modi. In December 2014, the bill was reintroduced as 122nd amendment and was finally passed by Lok Sabha on May 2015. After clearing the initial hurdle, bill with fresh amendments was passed by Rajya Sabha in August 2016. And finally the parliament passed all four GST bills in April 2017. After the passage, the rates on goods and services were finalized by GST council in May 2017.

After a hard fought battle of 17 years, the bill finally came into effect on 1st July 2017. Now the tax will be levied only on the value added at each level. The trader can now use the tax credit in one state to pay the interstate GST for business in other state. It needs to be seen how fast the Indian Economy adjusts itself to the new tax regime and catches up with high Growth Rate. As has been observed the world over, the Growth Rate has drastically dipped for some time after the implementation of GST.

One nation one tax.

To reduce tax corruption and to incease economic growth it is amilestone.

People have to learn more about it .

Tax rates should be reduced.